The Euro Zone is on the edge [UPDATE]

spiegel...

A Continent Stares into the Abyss

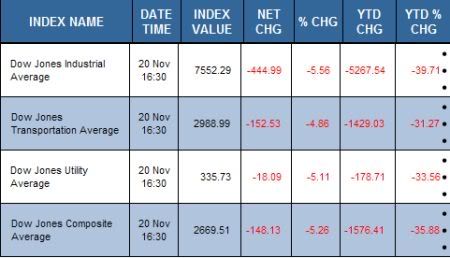

Fear is spreading through the financial markets as investors pull their money out of the crisis-stricken euro-zone countries. With Chancellor Angela Merkel ophttp://www.blogger.com/img/blank.gifposed to using the ECB's firepower to solve the crisis, the monetary union appears increasingly in danger of breaking apart. Some economists are even arguing for Germany to reintroduce the deutsche mark.

mm-hmmmm...

[UPDATE]

it looks like barack is worried about

from the guardian [emphasis added]...

Barack Obama is to press European Union officials to reach a definitive solution to their sovereign debt crisis, which is emerging as a major 2012 US election worry.

As Germany and France scramble to tighten budget controls across the eurozone, the European council president, Herman Van Rompuy, and the European commission president, José Manuel Barroso, will face tough questions from Obama at the White House on Monday on how much longer the crisis might go on.

No breakthroughs are expected from the meeting, which will not include the European heads of state who need to make crucial decisions about the future of the 17-nation currency union.

But Van Rompuy and Barroso wield influence as heads of key EU institutions at the heart of efforts to fight the crisis, which has thrown the future of the eurozone into doubt at a moment of weakness for the global economy.

what's at the root of barack's 2012 worry, i wonder...? is it merely the prospect of losing votes or that the super-rich elites who pump vast amounts of cash into obama's campaign coffers might either not have enough to throw his way or, if they do, might not be willing to fork it over...?

Labels: 2012 election, Angela Merkel, Barack Obama, deutsche mark, Euro Zone, European Central Bank, Euros, financial markets, financial meltdown, Germany

Submit To PropellerTweet

[Permalink] 0 comments