Tuesday, December 06, 2011

Wednesday, February 24, 2010

License to steal

robert scheer...

They do have a license to steal. There is no other way to read Tuesday’s report from the New York state comptroller that bonuses for Wall Street financiers rose 17 percent to $20.3 billion in 2009. Of course that is less than the $32.9 billion for bonus rewards back in 2007, when those hotshots could still pretend that they were running sound businesses.

The economy is anything but sound, but you would hardly know that from looking at the balance sheets of the big investment banks. The broker-dealer firms on Wall Street made a record profit, estimated at greater than $55 billion by the comptroller, and the only thing holding back even more grotesque bonuses was concern over criticism from a public that was hardly doing as well.

The enormous rewards last year come not from their having righted the ship of finance by lowering the rate of mortgage foreclosures for ordinary folks, one of four who are now “underwater” on their loans. Consumer confidence this month is the lowest in 27 years, and unemployment is expected to hover near 10 percent for the next two years. No, they get bonuses because the Federal Reserve, backed by the Treasury, bought the toxic mortgage securitization packages that Wall Street banks were left holding. They, and they alone, were made whole.

The way the scam worked is that the Treasury deposited taxpayer dollars with the Federal Reserve, which in turn purchased a whopping $1.25 trillion in toxic mortgages. That’s the figure after the Treasury on Tuesday committed to depositing $200 billion more with the Fed to increase spending on this program—one that was ostensibly designed to increase credit availability to small businesses and others but has hardly accomplished that goal. Credit is still very tight because the big financiers have used the low-cost cash they received from those charitable government programs to solidify their own positions through acquisitions and the like.

those of us privileged to live in the united states (and i say "privileged" because, despite the abominations taking place in my country, it's still a much better place to live overall than so many other places, places such as kosovo, for example, where i am currently sitting, writing this post) are understandably loath to face facts when they undermine the glorious image of our country that's been pounded into our heads from the time we learned to talk... but, it's a fact... we're being robbed, virtually at gunpoint, as mr. scheer rightly points out... however, we must also understand that it's not just us getting the shaft... these same people are perpetrating the same financial and economic devastation around the world... what's more, they serve as role models for such behavior... how, for instance, can i do effective work here in kosovo, a country awash in corruption and self-serving behavior from its leaders, when everyone can see what's happening in the very country that's preaching ethics and responsible behavior... it's maddening...

Labels: bailout, banksters, corruption, elites, Federal Reserve System, Kosovo, Robert Scheer, super-rich, Treasury Department, Truthdig

Submit To PropellerTweet

[Permalink] 0 comments

Tuesday, April 14, 2009

Nouriel Roubini throws a little cold water on the premature celebration of the big banks "passing" the stress test

According to preliminary results leaked to the New York Times, all 19 banks with assets above $100 billion that are subject to the Treasury’s ‘stress test’ are bound to pass the test. The official results are due by the end of April but the upbeat mood in the banking sector was already reflected in the 30% stock price rally in the run up to the Q1 earnings season. The major three commercial banks had already noted that they were profitable in the first two months of the year, and Wells Fargo announced that it expects to post a record net income of $3 billion when it reports results on April 22 (with combined net charge-offs of $3.3 billion for both Wells and Wachovia from $6.1 billion in the fourth quarter). Meanwhile, Goldman Sachs reported larger than expected Q1 earnings (ex December loss due to earnings calendar move) while at the same time raising fresh capital through a $5 billion stock sale in order to pay back the $10 billion in TARP money received last year.

A look below the surface reveals some caveats to this positive picture. As Nouriel Roubini points out in a recent writing: “In brief, banks are benefitting from close to zero borrowing costs and fewer competitors; they are benefitting from a massive transfer of wealth from savers to borrowers given a dozen different government bailout and subsidy programs for the financial system; they are not properly provisioning/reserving for massive future loan losses; they are not properly marking down current losses from loans in delinquency; they are using the recent mark-to-market accounting changes by FASB to inflate the value of many assets; they are using a number of accounting tricks to minimize reported losses and maximize reported earnings; the Treasury is using a stress scenario for the stress tests that is not a true stress scenario as actual data are already running worse than the worst case scenario.”

Other commentators also point to the fact that many of these banks were among the main recipients of AIG bailout funds in previous months, e.g. Goldman Sachs ($12.9 billion), Merrill Lynch ($6.8 billion), Bank of America ($5.2 billion), Citigroup ($2.3 billion) and Wachovia ($1.5 billion), according to New York Times data. The firms involved dismiss this factor as immaterial for Q1 earnings. Nevertheless, the GAO noted in a report at the end of March that Treasury should require that AIG seek additional concessions from employees and existing derivatives counterparties.

i refer interested readers to the post from hernando de soto about toxic derivatives i put up just the other day...

Labels: bank stress test, derivatives, Hernando de Soto, Nouriel Roubini, TARP, Treasury Department

Submit To PropellerTweet

[Permalink] 0 comments

Saturday, March 21, 2009

Atrios quotes John Cole - "We are so screwed"

A Cunning Plan

John Cole sums it up pretty well:

- The Illness- reckless and irresponsible betting led to huge losses

The Diagnosis- Insufficient gambling.

The Cure- a Trillion dollar stack of chips provided by the house.

The Prognosis- We are so screwed.

Labels: Atrios, bailout, economic collapse, Federal Reserve System, financial meltdown, financial services industry, Treasury Department

Submit To PropellerTweet

[Permalink] 0 comments

Thursday, February 26, 2009

THIRD bailout for Citi - how disgusting is this...?

The Treasury Department reached a deal late Thursday to take a stake of 30 to 40 percent in Citigroup as part of a third bailout of the embattled bank, according to several people close to the deal.

Vikram S. Pandit, the chief executive, will remain at the helm, but Citigroup will have to shake up its board so that it has a majority of independent directors, a move that federal regulators had already been pursuing.

Under the terms of the deal, the Treasury Department has agreed to convert up to $25 billion of its preferred stock investment in Citigroup into common stock.

It will convert its stake to the extent that Citigroup can persuade private investors, including several big foreign government investment funds, to do so alongside the government, two people close to the deal said.

The Treasury Department will match the private investors’ conversions dollar-for-dollar. That accounts for uncertainty in how big the government’s stake will be.

mish offers his usually trenchant perceptions on this travesty...

With all due respect Mr. President, Tim Geithner and Ben Bernanke are offering the same policies as President Bush and Secretary Paulson. Those policies are to bail out banks regardless of cost to taxpayers. Mr. President, it's hard enough to overlook Geithner's tax indiscretions. Mr. President, it is harder still, if not impossible, to ignore the fact that neither Geithner nor Bernanke saw this coming. Yet amazingly they are both cock sure of the solution. Even more amazing is the fact that [the] solution changes every day.

With all due respect Mr. President, Geithner and Bernanke are a huge part of the problem, and no part of the solution and the sooner you realize that the better off this nation will be

[...]

With all due respect Mr. President, you and Congress want to force banks to lend when banks (by not lending) are acting responsibly for the first time in a decade. Mr, President can you please tell us who banks are supposed to lend to? Do we need any more Home Depots? Pizza Huts? Strip malls? Nail salons? Auto dealerships? What Mr. President? What? And why should banks be lending when unemployment is rising and lending risks right along with it?

not much i can add to that...

Labels: bailout, Ben Bernanke, Citibank, economic collapse, financial meltdown, Mish, Tim Geithner, Treasury Department, Vikram Pandit

Submit To PropellerTweet

[Permalink] 0 comments

Friday, January 16, 2009

B.O.H.I.C.A. - the bailout continues as the financial meltdown shows no signs of abating

bank of america is the latest financial vampire to sink its teeth into the already-dessicated american taxpayer...

[T]he government agreed early Friday to provide an additional $20 billion infusion of capital into the bank and to cover the bulk of up to $118 billion in losses, largely arising from the bank’s Merrill acquisition.

Overall for 2008, Bank of America posted a net profit of $4.01 billion compared with net income of $14.98 billion a year earlier.

It said earnings were driven reflected “the deepening economic recession and extremely challenging financial environment, both of which significantly intensified in the last three months of 2008.”

but, wait...! there's MORE...! hold on to your wallets... citi is probably next in line...

Citigroup capped a devastating 2008 by announcing Friday that it would split into two entities and that it had posted an $8.29 billion loss for the fourth quarter.

When John A. Thain, left, of Merrill Lynch and Kenneth D. Lewis of Bank of America announced their companies’ merger in September, it looked as if Mr. Lewis had scored a coup. But now Bank of America is in need of more federal money to deal with Merrill’s losses.

Citigroup’s rival, Bank of America, also posted a loss, just hours after receiving a new infusion of government support.

Underlining the depth of the problems that have emerged from its acquisition of Merrill Lynch, Bank of America said Merrill had a fourth-quarter net loss of $15.31 billion, or $9.62 per diluted share, “driven by severe capital markets dislocations,” before the acquisition was completed.

Even as Bank of America was coping with the challenge of absorbing Merrill, Citigroup was announcing the latest steps in dismantling its own financial supermarket.

Citigroup confirmed that it would divide, for management purposes, into two separate businesses — Citicorp and Citi Holdings.

and, if you think things are slowing down in the financial meltdown department, check this out...

Last fall, as Federal Reserve and Treasury Department officials rode to the rescue of one financial institution after another, they took great pains to avoid doing anything that smacked of nationalizing banks.

They may no longer have that luxury. With two of the nation’s largest banks buckling under yet another round of huge losses, the incoming administration of Barack Obama and the Federal Reserve are suddenly dealing with banks that are “too big to fail” and yet unable to function as the sinking economy erodes their capital.

Particularly in the case of Citigroup, the losses have become so large that they make it almost mathematically impossible for the government to inject enough capital without taking a majority stake or at least squeezing out existing shareholders.

nationalized banks... cool...! it will be the absolute death knell for the capitalist, free-market, "invisible hand" quasi-religious ideology... and about goddam time, too...! < /snark >

Labels: bank failures, Bank of America, banking crisis, Citigroup, economic collapse, economy, Federal Reserve System, financial markets, financial meltdown, Treasury Department

Submit To PropellerTweet

[Permalink] 0 comments

Tuesday, December 02, 2008

Happy Holidays from all of us here at the Bureau of Slow-Motion Financial Collapse

i don't know about you, but i'm finding this slow-motion train wreck increasingly painful to watch... how about we just get it the hell over with...?

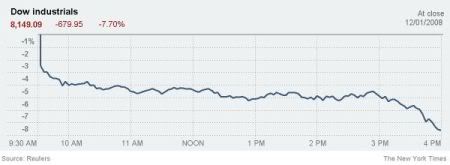

The Dow Jones industrial average dropped 679.95 points or 7.7 percent, all but wiping out a 783-point gain built up last week. The S.& P. 500 gave back 80 points of the 96-point gain from the same period. The Nasdaq composite index was also off 9 percent.

[...]

“To find out that we are 11 months into the recession with no end in sight, I think that concerns people,” [Douglas M. Peta, an independent market strategist] said. “It makes them say, gee, we’re right back into the territory of the 1980, 1981 twin recessions” — and past the more modest dips of the early 2000s and 1990s.

The Institute for Supply Management recorded the worst reading on the health of the manufacturing industry since 1982. “However you look at the numbers, the message is the same: manufacturing is in free fall, with output collapsing,” Ian Shepherdson of High Frequency Economics wrote in a note to clients. “We see no prospect for near-term improvement.”

That view may be underscored on Friday, when the government is expected to report that employers shed more than 300,000 jobs in November, a fresh sign of the problems facing American workers and businesses.

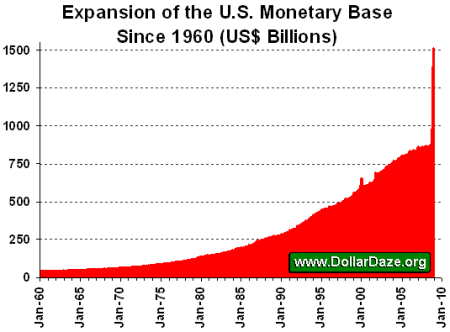

let's be done with it already and move on to building something that works instead of this absurd, debt-based, funny-money economy... just take a look at this chart...

The US Federal Reserve is increasing the monetary base at an unprecedented rate in response to the present deflationary asset crunch, following the longest running inflationary boom in the country's history.

Newly printed dollars are being used to replace the capital losses of America's corporations. If it were possible to replace wealth simply by printing money, humanity would have eliminated poverty shortly after discovering the printing press.

uh, yeah...

Labels: bailout, Dow Jones, economic collapse, Federal Reserve System, fiat money, financial meltdown, recession, Treasury Department, unemployment

Submit To PropellerTweet

[Permalink] 0 comments

Tuesday, November 25, 2008

The $7.76 TRILLION DOLLAR BAILOUT - enough to gag a maggot and could pay off HALF the country's mortgages!

The U.S. government is prepared to provide more than $7.76 trillion on behalf of American taxpayers after guaranteeing $306 billion of Citigroup Inc. debt yesterday. The pledges, amounting to half the value of everything produced in the nation last year, are intended to rescue the financial system after the credit markets seized up 15 months ago.

The unprecedented pledge of funds includes $3.18 trillion already tapped by financial institutions in the biggest response to an economic emergency since the New Deal of the 1930s, according to data compiled by Bloomberg. The commitment dwarfs the plan approved by lawmakers, the Treasury Department’s $700 billion Troubled Asset Relief Program. Federal Reserve lending last week was 1,900 times the weekly average for the three years before the crisis.

When Congress approved the TARP on Oct. 3, Fed Chairman Ben S. Bernanke and Treasury Secretary Henry Paulson acknowledged the need for transparency and oversight. Now, as regulators commit far more money while refusing to disclose loan recipients or reveal the collateral they are taking in return, some Congress members are calling for the Fed to be reined in.

“Whether it’s lending or spending, it’s tax dollars that are going out the window and we end up holding collateral we don’t know anything about,” said Congressman Scott Garrett, a New Jersey Republican who serves on the House Financial Services Committee. “The time has come that we consider what sort of limitations we should be placing on the Fed so that authority returns to elected officials as opposed to appointed ones.”

so, how does this all trickle down to you and me...?

The money that’s been pledged is equivalent to $24,000 for every man, woman and child in the country. It’s nine times what the U.S. has spent so far on wars in Iraq and Afghanistan, according to Congressional Budget Office figures. It could pay off more than half the country’s mortgages.

and, ferchrissake, they won't even tell us WHO'S GETTING THE GODDAM MONEY...!

“Some have asked us to reveal the names of the banks that are borrowing, how much they are borrowing, what collateral they are posting,” Bernanke said Nov. 18 to the House Financial Services Committee. “We think that’s counterproductive.”

The Fed should account for the collateral it takes in exchange for loans to banks, said Paul Kasriel, chief economist at Chicago-based Northern Trust Corp. and a former research economist at the Federal Reserve Bank of Chicago.

“There is a lack of transparency here and, given that the Fed is taking on a huge amount of credit risk now, it would seem to me as a taxpayer there should be more transparency,” Kasriel said.

if it feels suspiciously like we're getting screwed big-time, i would have to say, a la sarah palin, "YOU BETCHA...!"

Labels: bailout, Ben Bernanke, Bloomberg, Citigroup, Congress, economic collapse, financial meltdown, Henry Paulson, House Financial Services Committee, Sarah Palin, transparent, Treasury Department

Submit To PropellerTweet

[Permalink] 0 comments

Saturday, October 25, 2008

What's this crap about "taking an ownership stake"...? It's nationalization, fercryinoutloud...

The Treasury Department is dramatically expanding the scope of its bailout of the financial system with a plan to take ownership stakes in the nation's insurance companies, signaling new concerns about a sector of the economy whose troubles until now have been overshadowed by the banking industry, government and industry sources said.

Insurers, including The Hartford, Prudential and MetLife, have pushed the Bush administration to include them in the plan. Many firms have taken losses from mortgage-related securities and other investments and are struggling to replenish their coffers.

Government officials worry that the collapse of a major insurer could further destabilize the financial system because of the crucial role the companies play in backstopping a wide range of financial transactions, although the direct impact on holders of car, life and other insurance policies would be modest, industry officials said.

The new initiative underscores the growing range of problems that Treasury is scrambling to address with the $700 billion allocated by Congress this month. The shape of the plan has changed repeatedly since Treasury Secretary Henry M. Paulson Jr. introduced it last month as an effort to rescue banks by buying their troubled mortgage-related assets. That original mandate has now been pushed aside by a plan to take equity stakes in banks and insurance companies, and other businesses are lobbying to be included.

The government has been forced to expand the plan partly because the federal guarantees previously given some institutions, such as banks, have put other companies and financial sectors at a disadvantage, making them less attractive to uneasy investors.

The government's power to choose winners and losers in the crisis was illustrated yesterday when the Cleveland-based bank National City was forced to sell itself when regulators turned down its request for a Treasury investment after deciding the firm was too weak to save, according to people familiar with the matter. Instead, the Treasury gave $7.7 billion to PNC Financial Services Group to help buy National City. It did not require that the money be used for new lending, the stated purpose of the government plan. PNC, which has a major presence in the Washington region, would become the fifth-largest bank in the country by deposits.

the size of the bailout seems to grow exponentially minute-by-minute... pretty soon, pharmacy chains are going to be included because people are cutting down on refilling their prescriptions...

With the economy in crisis, people are cutting back on their prescriptions because they can't afford them.

A recent study says the number of prescriptions filled through August of this year is down compared to the same time period last year.

and then we'll bail out the restaurants because people can't afford to eat out as much...

Labels: bailout, banking crisis, Congress, economic collapse, financial markets, financial meltdown, Henry Paulson, insurance companies, nationalization, Treasury Department

Submit To PropellerTweet

[Permalink] 0 comments

Monday, September 22, 2008

"Every market is just out of control right now." So, how's that bailout workin' for ya, eh...?

Stocks fell sharply and oil prices suddenly spiked on Monday as investors anxiously waited for Washington lawmakers to hash out the details of the biggest government bailout in history — a politically fraught process that will create a new slate of winners and losers on Wall Street.

That uncertainty, about a shaken financial system still in flux, appeared to spook investors away from assets tied directly to the health of the American government. The dollar dropped sharply against the euro, and oil prices jumped, closing up more than $16 a barrel.

The Dow Jones industrials closed down 372 points after spending the day deep in negative territory. The broader Standard & Poor’s 500-stock index finished down 3.8 percent.

“What can I say? Every market is just out of control right now,” said Tom Bentz, an energy analyst at BNP Paribas.

ferchrissake, let's let the house of cards fall down already...

Labels: $700B bailout, Dow Jones, economic collapse, financial markets, financial meltdown, oil prices, Treasury Department, U.S. dollar, Wall Street

Submit To PropellerTweet

[Permalink] 0 comments

Sunday, September 21, 2008

More bullshit maneuvering by the Fed PLUS now EVERBODY wants access to the federal tit

In one of the biggest changes to Wall Street in decades, Goldman Sachs and Morgan Stanley, the last two independent investment banks, will become bank holding companies, the Federal Reserve said Sunday night.

The move fundamentally changes one of the mainstays of modern Wall Street. It heralds new regulations and supervisions of previously lightly regulated investment banks.

The move comes after the bankruptcy of Lehman Brothers and the near-collapses of Bear Stearns and Merrill Lynch.

Being a bank holding company would give Morgan and Goldman access to the discount window of the Federal Reserve. While they have had access to Fed lending facilities in recent months, regulators had planned to take away discount window access in January.

The regulation by the Federal Reserve brings a host of accounting rule changes that should benefit the two banks in the current environment.

the rules ain't workin' for ya...? no sweat... change them goddam, pesky rules...

as if that weren't enough to gag a maggot, ALL the piggies want a place at the trough...

Even as policy makers worked on details of a $700 billion bailout of the financial industry, Wall Street began looking for ways to profit from it.

Financial firms were lobbying to have all manner of troubled investments covered, not just those related to mortgages.

At the same time, investment firms were jockeying to oversee all the assets that Treasury plans to take off the books of financial institutions, a role that could earn them hundreds of millions of dollars a year in fees.

Nobody wants to be left out of Treasury’s proposal to buy up bad assets of financial institutions.

“The definition of Financial Institution should be as broad as possible,” the Financial Services Roundtable, which represents big financial services companies, wrote in an e-mail message to members on Sunday.

The group said a wide variety of institutions as varied as mortgage lenders and insurance companies should be able to take advantage of the bailout, and that these companies should be able to sell off any investments linked to mortgages.

The scope of the bailout grew over the weekend. As recently as Saturday morning, the Bush administration’s proposal called for Treasury to buy residential or commercial mortgages and related securities. By that evening, the proposal was broadened to give Treasury discretion to buy “any other financial instrument.”

call and write your senators... call and write your congressman... call or write your newspaper... scream bloody murder... this shit has got to stop... NOW...!!

Labels: Goldman Sachs, Lehman Bros, Morgan Stanley, Treasury Department, Wall Street

Submit To PropellerTweet

[Permalink] 0 comments

Just say "NO" to a $700B blank check with no administrative oversight and no legal or legislative review

Unveiling its plan to rescue the nation's financial system from near-paralysis, the Bush administration is asking Congress for the authority to spend $700 billion and for powers to intervene in the economy so sweeping that they have virtually no precedent in U.S. history.

[...]

The dollar figure alone is remarkable, amounting to 5% of the nation's gross domestic product. But the most distinctive -- and potentially most controversial -- element of the plan is the extent to which it would allow Treasury to act unilaterally: Its decisions could not be reviewed by any court or administrative body and, once the emergency legislation was approved, the administration could raise the $700 billion through government borrowing and would not be subject to Congress' traditional power of the purse.

"Nothing quite of this scale has happened since the early years of the country when Alexander Hamilton wrote the Treasury act to give him the power to borrow and intervene in markets," said New York University financial historian Richard Sylla. And in Hamilton's case, Congress quickly clipped his wings, and no successor -- not even under President Franklin D. Roosevelt at the height of the Depression -- exercised quite such unfettered power again.

"It essentially creates an economic czar with no administrative oversight, no legal review, no legislative review. And it gives one man $700 billion to disperse as he needs fit," said Sen. Dianne Feinstein (D-Calif.), referring to Treasury Secretary Henry M. Paulson.

"He will have complete, unbridled authority subject to no law," she said.

like i've said so many times i've lost count, it's all about money and power and insuring that the average united states citizen has neither...

Labels: $700B bailout, bailout, Bush Administration, Congress, Dianne Feinstein, economic collapse, financial meltdown, Henry Paulson, Treasury Department

Submit To PropellerTweet

[Permalink] 0 comments

Friday, September 19, 2008

The continuing stages of financial collapse and the denial that goes along with it

a few of the latest stories, all of them no less than stunning, none of them comforting...

first this...

S.E.C. Temporarily Blocks Short Sales of Financial Stocks

The Securities and Exchange Commission on Friday issued a temporary ban on short sales of 799 financial stocks, a move against traders who have sought to profit from the financial crisis by betting against bank shares.

The temporary ban, intended to bring calm to the markets, follows similar action by Britain on Thursday.

The S.E.C. said the “temporary emergency action” would “protect the integrity and quality of the securities market and strengthen investor confidence.”

The commission said it was also considering measures to address short selling in other publicly traded companies.

then this...

Treasury to Guarantee Money Market Funds

The federal government took two actions on Friday to shore up money market funds, which have long been considered as safe and risk-free as a bank savings account, but which have come under stress in the current market turmoil.

The Federal Reserve said that it would expand its emergency lending program to help support the $2 trillion in assets of the funds.

And the Treasury Department said that it would guarantee, at least temporarily, money market funds up to an amount of $50 billion in order to ensure their solvency.

“For the next year, the U.S. Treasury will insure the holdings of any publicly offered eligible money market mutual fund — both retail and institutional — that pays a fee to participate in the program,” the Treasury said in a statement.

The department said concerns about the value of money market funds falling below the standard net asset value of $1 — or “breaking the buck” — had heightened the financial turmoil and caused severe liquidity strains in world markets.

followed in short order by this...

Stocks Surge as U.S. Acts to Shore Up Money Funds and Limits Short Selling

Stocks shot wildly upward Friday morning after the federal government moved to try and restore confidence in the financial markets.

The Dow Jones industrial average was up more than 400 points only moments after the opening. The broader Standard & Poor’s 500 was up 4 percent. Markets in Europe and Asia also traded higher.

our fearless leaders know that there are gazillions of people out there who simply MUST, for their own sanity, find a way to continue to believe in our utterly failed financial system and will hang on to their denial until the last thread is ripped away by the sheer force of reality... i can't say as i blame them... when your entire worldview and belief system is based on power, money and the power of money, letting go of those beliefs is going to be at least as hard as kicking a long-standing drug addiction and, in fact, probably considerably harder...

Labels: addiction, Britain, economic collapse, Federal Reserve System, financial markets, financial meltdown, money market, short sales, Treasury Department, United States

Submit To PropellerTweet

[Permalink] 0 comments

Monday, September 15, 2008

C'mon, dammit, let's let the friggin' house of cards FALL already...!

The churn of a rapidly changing financial landscape left Wall Street cold on Monday, as a late afternoon sell-off sent the stock market to its worst daily loss in seven years.

The Dow Jones industrial average plummeted more than 500 points — its worst session since the days after the Sept. 11, 2001 terrorist attacks.

The blue-chip index spent the entire day in negative territory, but the losses did not begin approaching dramatic levels until late in the afternoon. In the last 30 minutes of trading, investors seemed to give in to their fears about the health of the financial system, sparking a wave of selling that sent the Dow, already about 300 points lower, to a 504.48 point decline for the day.

The Standard & Poor’s 500-stock index fared even worse, losing 4.7 percent, and the technology-heavy Nasdaq composite index fell 3.2 percent. In Europe, benchmark stock indexes were off nearly 4 percent in London and Paris and almost 3 percent in Frankfurt.

meanwhile, hank paulson, the flaming bush mouthpiece that he is, tries to pour oil on the troubled waters...

In a briefing in Washington, Treasury Secretary Henry M. Paulson Jr. said the financial markets were going through a tough time “as we work off some of the past excesses,” but that Americans could “remain confident in the soundness and the resilience of our financial system.”

“Let me step back a bit and provide a little perspective,” Mr. Paulson said. “As I’ve long said, the housing correction is at the root of the challenges facing our markets and our financial institutions. I believe that we’ve taken very important steps with respect to Fannie Mae and Freddie Mac, and they’re amongst the most important actions we can take to work through this turmoil.”

if hankie-poo is expecting us to swallow that enormous load of fresh, steaming shit, when every time we've watched yet another financial bridge burn in the past nine months, he's said the very same goddam thing, and, each time, the next bridge that catches fire is a bigger bridge and the span of water that it crosses is increadingly unnavigable, i ain't buyin' a single goddam syllable that passes his lying lips...

Labels: Dow Jones, economic collapse, Fannie Mae, financial meltdown, Freddie Mac, Henry Paulson, stocks, Treasury Department

Submit To PropellerTweet

[Permalink] 0 comments

Saturday, March 29, 2008

The financial version of Homeland Security - the mad scramble to avoid the inevitable economic collapse

The Treasury Department will propose on Monday that Congress give the Federal Reserve broad new authority to oversee financial market stability, in effect allowing it to send SWAT teams into any corner of the industry or any institution that might pose a risk to the overall system.

[...]

Many of the proposals, like those that would consolidate regulatory agencies, have nothing to do with the turmoil in financial markets. And some of the proposals could actually reduce regulation.

According to a summary provided by the administration, the plan would consolidate an alphabet soup of banking and securities regulators into a powerful trio of overseers responsible for everything from banks and brokerage firms to hedge funds and private equity firms.

While the plan could expose Wall Street investment banks and hedge funds to greater scrutiny, it carefully avoids a call for tighter regulation.

The plan would not rein in practices that have been linked to the housing and mortgage crisis, like packaging risky subprime mortgages into securities carrying the highest ratings.investment bank’s practices threatened the entire financial system.

The plan would give the Fed some authority over Wall Street firms, but only when an investment bank’s practices threatened the entire financial system.

sounds as worthless as teats on a boar...

Labels: economic collapse, economy, Federal Reserve System, financial markets, financial meltdown, Treasury Department

Submit To PropellerTweet

[Permalink] 0 comments

Thursday, March 27, 2008

World's 5th biggest pension fund stops buying U.S. Treasury bonds

South Korea's National Pension Service (NPS), the world's fifth-biggest pension fund, said on Thursday it was shying away from U.S. Treasuries because of falling yields and the weakening dollar.

The move by the NPS could signal a big shift by financial institutions away from U.S. government debt into higher-yielding assets, the Financial Times said.

The fund, which expects its assets to rise to 250 trillion won ($253 billion) by the end of 2008, holds about 17.4 trillion won worth of foreign bonds of which U.S. Treasuries account for 94 percent.

Those figures would suggest NPS holds about 16.4 trillion ($16.6 billion) won in U.S. Treasuries.

"We sees the attractiveness of U.S. Treasuries falling," NPS spokeswoman, Chi Younghye, said.

it may not be front-page news, but unlike other stories that don't get the coverage they deserve, this one is creating a hole of such staggering proportions that, when we finally fall in, the world as we know it will cease to exist...

Labels: economic collapse, economy, financial markets, financial meltdown, Treasury bonds, Treasury Department, U.S. dollar

Submit To PropellerTweet

[Permalink] 0 comments

Monday, March 24, 2008

Yeah, yeah, yeah... You make an obscenely lowball bid to cash in on people's pain, you get a little resistance...

JPMorgan Raises Bid for Bear Stearns to $10 a Share

The sweetened offer is intended to win over stockholders who

vowed to fight the original fire-sale deal, struck only a

week ago at the behest of the Federal Reserve and Treasury

Department.

Labels: Bear Stearns, economic collapse, economy, Federal Reserve System, financial markets, financial meltdown, JPMorgan Chase, Treasury Department

Submit To PropellerTweet

[Permalink] 0 comments

Tuesday, February 12, 2008

Thursday, May 24, 2007

Paulson, Wu Yi, Strategic Economic Dialogue on China, and press spin

The United States and China struck civil aviation and financial sector access deals on Wednesday but they made no headway on the divisive issue of Chinese currency reform, stoking anger on Capitol Hill.

Lawmakers said they would move ahead with proposals to slap tariffs on Chinese imports because of Beijing's reluctance to redress the huge trade imbalance between the economic giants with a revaluation of the yuan.

The anger in Congress overshadowed U.S. Treasury Secretary Henry Paulson's claim of "tangible results" in the second leg of a "strategic economic dialogue" with Chinese Vice Premier Wu Yi.

Wu, for her part, said the "complicated" relations between Washington and Beijing needed careful handling and cautioned against retaliatory steps.

[...]

The most concrete outcome of the talks was a deal committing China to remove a bar on new foreign securities firms and resume issuing licenses for securities companies, including joint ventures, in the second half of 2007.

That was a coup for former Goldman Sachs chairman Paulson, who has made gaining greater access to the Chinese financial sector a key objective.

other than reporting on "no headway on currency reform", a reference to "anger in congress", and quoting madame wu yi's statement that relations were "complicated" and commenting on not taking "retaliatory steps", there was no mention of this...

Wow. Secretary of the Treasury Hank Paulson just about did everything wrong but spit on Chinese Vice Premier Wu Yi today at the premature wrap-up of the Strategic Economic Dialogue (SED) meeting in Washington.

that was steve clemons in the washington note who then offered this from chris nelson's subscription-only nelson report...

"Results", with one or two exceptions, either were minimal, or not what Secretary Paulson seemed to expect. And at the closing press conference, the Chinese didn't even pretend they had had a good time. Madam Wu Yi read her statement, and walked off. No pretence of a friendly hug for the US side.

[...]

One normally hesitates to ascribe too much to the theater of body language, but here's something that just bashes you right between the eyes: Paulson, the guy with 72 private trips to China, all that hands-on experience, he who told the White House, State and USTR not to worry, that he would be the China Guy in this Administration...at the closing press conference, Paulson stalked in, well ahead of Wu Yi, and then started reading his statement before she even reached the podium.

Excuse me? An American or European would have cold-cocked the President for such calculated rudeness! In China (Japan, Korea, etc.) you watch older married couples walk into someplace. . .the husband is 10 feet in front, and the subservient wife is dutifully plodding behind. You think for one minute that elderly maiden lady Wu Yi didn't catch the insult here?

Or, are you telling us Paulson didn't mean it, that he was so focused on reading his prepared statement he didn't think? NONSENSE. This was a calculated act of rudeness which told everyone in the room, and anyone watching on TV, that a major failure had taken place.

Further evidence of a Paulson snit. . .he seemed to go out of his way to be rude to an Asian journalist, who had to ask him four times, in very good english, something about the N. Korea/Macao money problems Treasury is having with State (see separate item in tonight's Report). Paulson pretended not to be able to understand what everyone else in the room got the first time.

why does this sound so familiar...? could it be that high-handed, boorish arrogance is REQUIRED for bush administration high-level political appointees...? what else seems to ring a bell...? oh, yeah... no mention of paulson's boorishness in the media...

Labels: China, Chinese Vice Premier Wu Yi, Congress, free trade, Henry Paulson, Strategic Economic Dialogue, tariffs, Treasury Department, White House

Submit To PropellerTweet

[Permalink] 0 comments

Friday, May 11, 2007

Let's see if the tried-and-true, wait-it-out strategy works for Wolfie too

don't you just LOVE the spin? "the whole world is watching..." oh, yes, it surely is... but they're NOT watching to see that wolfie is treated fairly... oh,no... they're watching to see if someone who should never have been appointed in the first goddam place and has demonstrated conclusively WHY he should never have been appointed in the first goddam place is going to be held accountable... THAT'S what they're waiting to see... THAT'S what we've been waiting to see with gonzo too... ya, right...

The United States warned on Thursday that "the whole world is watching" to see that embattled World Bank President Paul Wolfowitz is treated fairly as critics press him to quit over a pay-and-promotion dispute.

Treasury Secretary Henry Paulson, in a measured response stressing the importance of preserving the global lender's standing, told a questioner Wolfowitz deserved fair process as the bank board prepares to consider his fate.

Some European members want Wolfowitz's resignation over a controversial pay and promotion deal he approved in 2005 for his companion, bank Middle East expert Shaha Riza, but the Bush administration has stood by the former Pentagon official.

Paulson said on Bloomberg television that he considered Wolfowitz "a dedicated and committed public servant" who had done valuable work at the World Bank. Wolfowitz has been given until Friday to respond to a bank panel report that found his actions in the pay and promotion deal broke rules.

"It's got to be fair," Paulson said. "A bank with the stature of the World Bank (and) I have the highest regard for the World Bank, the processes they use here are going to be very important, the whole world is watching."

Labels: Bush Administration, Europe, George Bush, Henry Paulson, Middle East, Paul Wolfowitz, Shaha Riza, Treasury Department, World Bank

Submit To PropellerTweet

[Permalink] 0 comments