Happy Holidays from all of us here at the Bureau of Slow-Motion Financial Collapse

i don't know about you, but i'm finding this slow-motion train wreck increasingly painful to watch... how about we just get it the hell over with...?

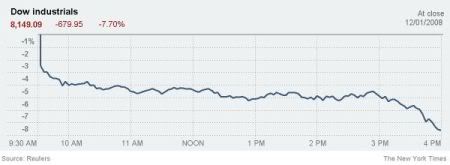

The Dow Jones industrial average dropped 679.95 points or 7.7 percent, all but wiping out a 783-point gain built up last week. The S.& P. 500 gave back 80 points of the 96-point gain from the same period. The Nasdaq composite index was also off 9 percent.

[...]

“To find out that we are 11 months into the recession with no end in sight, I think that concerns people,” [Douglas M. Peta, an independent market strategist] said. “It makes them say, gee, we’re right back into the territory of the 1980, 1981 twin recessions” — and past the more modest dips of the early 2000s and 1990s.

The Institute for Supply Management recorded the worst reading on the health of the manufacturing industry since 1982. “However you look at the numbers, the message is the same: manufacturing is in free fall, with output collapsing,” Ian Shepherdson of High Frequency Economics wrote in a note to clients. “We see no prospect for near-term improvement.”

That view may be underscored on Friday, when the government is expected to report that employers shed more than 300,000 jobs in November, a fresh sign of the problems facing American workers and businesses.

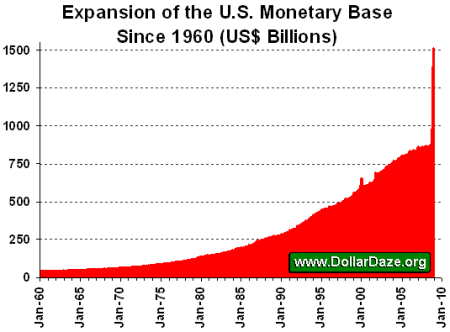

let's be done with it already and move on to building something that works instead of this absurd, debt-based, funny-money economy... just take a look at this chart...

The US Federal Reserve is increasing the monetary base at an unprecedented rate in response to the present deflationary asset crunch, following the longest running inflationary boom in the country's history.

Newly printed dollars are being used to replace the capital losses of America's corporations. If it were possible to replace wealth simply by printing money, humanity would have eliminated poverty shortly after discovering the printing press.

uh, yeah...

Labels: bailout, Dow Jones, economic collapse, Federal Reserve System, fiat money, financial meltdown, recession, Treasury Department, unemployment

Submit To PropellerTweet