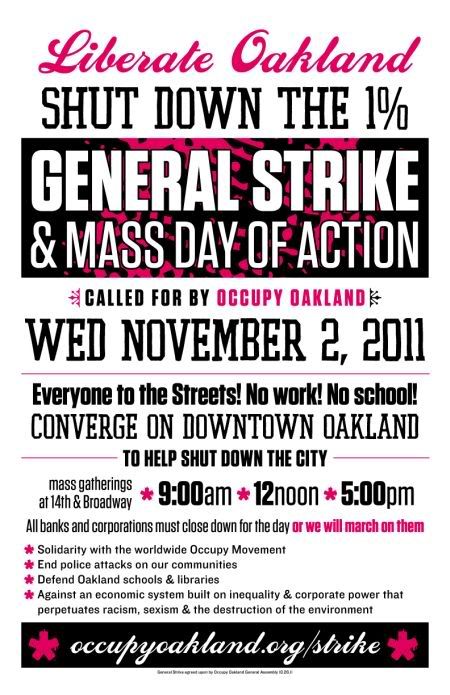

Let's have a jubilee - forgive the debtors, the banks have already been forgiven

The rebellious citizens occupying Wall Street shock some people and inspire others with their denunciations of bankers, but everyone seems to know what they are talking about: the barbaric and suffocating behavior of the nation’s largest banks (yes, the same ones the government rescued with public money). Right now, these trillion-dollar institutions are methodically harvesting the last possible pound of flesh from millions of homeowners before kicking these failing debtors out of their homes (the story known as the “foreclosure crisis”). This is a tragedy for the people who are dispossessed. For the country, it is a generational calamity.

[...]

There is a solution, and it will appeal to the rebellious spirits occupying Wall Street because it combines a sense of social justice with old-fashioned common sense. It is forgiveness—forgive the debtors. Write down the principal they owe on their mortgage to match the current market value of their home, so they will no longer be underwater. Refinance the loan with a reduced interest rate, so the monthly payment is at a level that the struggling homeowner can handle. This keeps families in their homes, with a renewed stake in the future. It gives homeowners incentive to keep up their payments, because once again they have some equity and the opportunity to accumulate much more.

[...]

Forgiving the debtors is the right thing to do, because the bankers have already been forgiven. The largest banks were in effect relieved of any guilt—for their crimes of systemic fraud or for causing the financial breakdown—when the government bailed them out, no questions asked. The Obama administration followed up with a very forgiving regulatory policy that basically looked the other way and ignored the fictional claims on bank balance sheets. Instead of forcing honest accounting and rigorous reform, the administration adopted a strategy of soft-hearted regulation that banking insiders call “extend and pretend”: extend the failed loans and pretend that the loans will be paid off, even when you know many of them won’t. The phrase originated during the third world debt crisis in the 1980s, when the Federal Reserve rescued the same big banks from insolvency, the result of their reckless lending in Latin America.

greider calls up the historical tradition of "jubilee," a concept david graeber raised in a post i put up not long ago...

The ancient Hebrew society worked out a solution for recurring debt crises—you can find it in the Bible. Every seven years (in some interpretations, every fifty) the cycle of debt accumulation was erased by a declaration of general forgiveness. This was called the year of jubilee, and Christianity embraced the same moral principles (“forgive us our debts, as we forgive our debtors”). Property was returned to the original owners, and children and slaves were freed. Everyone was redeemed. The economy was freed to start over again.

a description of jubilee in the judeo-christian context (from wikipedia)...

The concept of the Jubilee is a special year of remission of sins and universal pardon. In the Biblical Book of Leviticus, a Jubilee year is mentioned to occur every fifty years, in which slaves and prisoners would be freed, debts would be forgiven and the mercies of God would be particularly manifest. In Christianity, the tradition dates to 1300, when Pope Boniface VIII convoked a holy year, following which ordinary jubilees have generally been celebrated every 25 or 50 years; with extraordinary jubilees in addition depending on need. Christian Jubilees, particularly in the Catholic tradition, generally involve pilgrimage to a sacred site, normally the city of Rome.

i like it... i like it a lot...

Labels: banksters, David Graeber, debt forgiveness, jubilee, William Greider

Submit To PropellerTweet

[Permalink] 0 comments