The stage is set and the main actors in Congress and in the corporate establishment are ready to perform after rehearsing behind closed doors for the coming assault on organized labor's most powerful sector: public workers.

The final preparations were smoothed out in Obama's tax "compromise" with the Republicans, which gave details of the drama's first act. The tax plan purposely did not include a critical element for state funding, called the Build America Bonds program (BAB), which allows recession-sunk states to easily borrow money from the federal government. In the face of enormous deficits, the states would be left to drown. Reuters blogger James Pethokoukis explains:

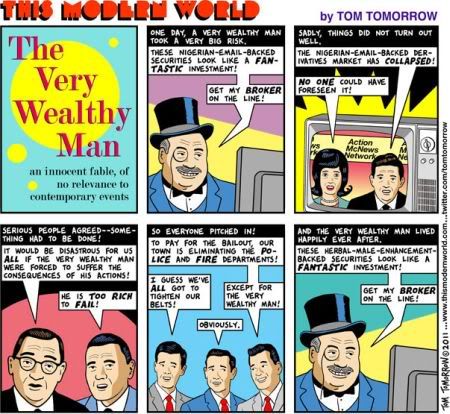

Congressional Republicans [and Democrats] appear to be quietly but methodically executing a plan that would a) avoid a federal bailout of spendthrift states and b) cripple public employee unions by pushing cash-strapped states such as California and Illinois to declare bankruptcy. This may be the biggest political battle in Washington, my Capitol Hill sources tell me, of 2011.

Public employee unions would be crippled by bankruptcy because union contracts are notoriously easy to shred in the court system, where "nonpartisan" judges always decide against unions.

To further ensure that states will become bankrupt, yet another law was recently proposed that, if approved, will keep money out of states' pockets by making it harder for states to sell public bonds. This law demands that states use overly strict accounting methods when reporting their debts to public workers' retirement accounts, so that the state's "credit worthiness" will shrivel. (Reagan used the same trick to destroy the pensions offered for private-sector workers.)

Two birds are killed with one stone: public employees will find their pensions under further attack, while states will be refused credit because of the new accounting methods. The New York Times explains:

The bill gives local governments a choice: they can report [pension obligations] the way the [Congressional] members want them to report, or they can give up the ability to issue tax-exempt bonds. That is, of course, no choice at all.

and:

In the end, I suspect ways will be found to abrogate some pension promises. But even if that does not happen, the trend away from defined-benefit pensions is likely to affect most younger public employees, as it already has their counterparts in the private sector. The retirement safety net will thus become a little more frayed.

In summary, pensions for state workers are on the cutting board, to be replaced by the 401(k) scam, while state bankruptcy will "abrogate" [abolish] union contracts. But as it stands now, states cannot legally declare bankruptcy. This minor obstacle is being handled quickly for showtime, as Pethokoukis explains:

Some Republicans hope the shock of the newly revealed [state] debt totals will grease the way towards explicitly permitting states to declare bankruptcy. Indeed, legislation amending federal bankruptcy law is currently being prepared by congressional Republicans.

The current Congress and President Obama are intentionally creating a nationwide anti-union atmosphere. The Democrats' silence over the above issues is, in fact, a signal of approval. In the same way that Obama announced a federal pay freeze for federal workers, federal actions towards labor quickly set the tone for how states deal with labor. Right-wing forces are consequently given the green light, and Democratic and Republican state representatives will do their best to implement their own anti-labor laws to ingratiate themselves to the feds in the hopes of promotion. The feds act as a music conductor and the states respond as an orchestra.