Occupy is poised to wash over American society vs. If ever I saw a dead movement, it is surely Occupy

bill zimmerman in truthout...

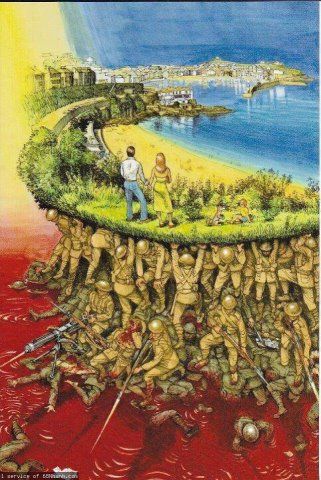

The Aftermath of Occupy Will Surpass the Gains of 1960s Activism

A tsunami of citizen activism, initiated by Occupy Wall Street, is poised to wash over American society. The coming battle to correct the grotesquely unequal distribution of wealth and power in this country is likely to have an even more profound impact on our society than what occurred in the 1960s.[...]But the difficulty in actually achieving economic reform leaves many skeptical that a new movement can succeed. Granted, true economic reform is a greater challenge than the battles for political and human rights that we waged in the 1960s. But the other side of that coin is that such a movement can have tremendous staying power because the economic conditions provoking it are unlikely to change and the supply of ready new protesters will not diminish.Skeptics also argue that the activists of the Occupy demonstrations and foreclosure protests are incapable of forging lasting organization, that despite their tactical creativity and their remarkable impact on the national dialogue, they lack leadership and a systematic analysis. True enough, but today's activism remains in the first blush of its growth and is still perfecting its social media organizing techniques. Political movements can mature with blistering speed.[...]A new movement is being born. Jobless young troublemakers being thrown away by society understand that the extreme disparities in wealth and power that are the cause of their problems will not disappear on their own. Behind these young people will be millions of dissatisfied workers pursuing the American dream denied. That is why the coming era of citizen activism is likely to dwarf what my generation accomplished in the 1960s. We altered the country, culturally, socially, sexually and spiritually. The next wave of activism will change it economically.

Biggest Financial Scandal in Britain’s History, Yet Not a Single Occupy Sign; What Happened?

People have written complicated pieces trying to prove it’s not over, but if ever I saw a dead movement, it is surely Occupy.

Has it left anything worth remembering? Yes, maybe. With Bob Diamond squirming before British MPs, and politicians jostling to apportion blame for the Barclays scandal, memories of the 99 per cent and the one per cent are surely at least warm in the coffin.

Everything leftists predicted came true, just as everything hard-eyed analysts predicted about the likely but unwelcome course of ecstatic populism in Tahrir Square also came true. ·I do think it’s incumbent on those veteran radicals who wrote hundreds of articles more or proclaiming a religious conversion to Occupyism, to give a proper account of themselves, otherwise it will happen all over again.

Labels: activists, Alexander Cockburn, Barclays Bank, Bill Zimmerman, Bob Diamond, Counterpunch, economic injustice, Occupy, Occupy Wall Street, social movements, Truthout

Submit To PropellerTweet

[Permalink] 0 comments