Taxing the rich to make investments that grow the middle class, is the single smartest thing we can do for the middle class, the poor and the rich

I can say with confidence that rich people don't create jobs, nor do businesses, large or small. What does lead to more employment is a "circle of life" like feedback loop between customers and businesses. And only consumers can set in motion this virtuous cycle of increasing demand and hiring. In this sense, an ordinary middle-class consumer is far more of a job creator than a capitalist like me.[...]Anyone who's ever run a business knows that hiring more people is a capitalist's course of last resort, something we do only when increasing customer demand requires it. In this sense, calling ourselves job creators isn't just inaccurate, it's disingenuous.

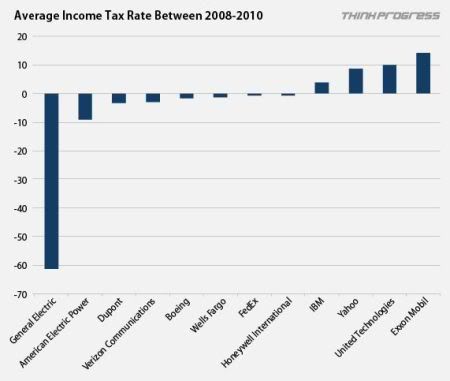

That's why our current policies are so upside down. When you have a tax system in which most of the exemptions and the lowest rates benefit the richest, all in the name of job creation, all that happens is that the rich get richer.[...]If it were true that lower tax rates and more wealth for the wealthy would lead to more job creation, then today we would be drowning in jobs. And yet unemployment and under-employment is at record highs.

Another reason this idea is so wrong-headed is that there can never be enough super-rich Americans to power a great economy. The annual earnings of people like me are hundreds, if not thousands, of times greater than those of the median American, but we don't buy hundreds or thousands of times more stuff. My family owns three cars, not 3,000. I buy a few pairs of pants and a few shirts a year, just like most American men. Like everyone else, we go out to eat with friends and family only occasionally.

I can't buy enough of anything to make up for the fact that millions of unemployed and underemployed Americans can't buy any new clothes or cars or enjoy any meals out. Or to make up for the decreasing consumption of the vast majority of American families that are barely squeaking by, buried by spiraling costs and trapped by stagnant or declining wages.[...]We've had it backward for the last 30 years. Rich businesspeople like me don't create jobs. Rather they are a consequence of an eco-systemic feedback loop animated by middle-class consumers, and when they thrive, businesses grow and hire, and owners profit. That's why taxing the rich to pay for investments that benefit all is a great deal for both the middle class and the rich.

So here's an idea worth spreading.

In a capitalist economy, the true job creators are consumers, the middle class. And taxing the rich to make investments that grow the middle class, is the single smartest thing we can do for the middle class, the poor and the rich.

Labels: capitalism, consumption, economy, elites, job creators, middle class, super-rich, taxes, TED, unemployment

Submit To PropellerTweet

[Permalink] 2 comments